Can the Suez Channel and the Panama Canal Disruptions, Forever Reshape Global Supply Chains?

Global trade is a very intricate web, with the Suez Channel and the Panama Canal being at the very center of this complex system. These maritime shortcuts facilitate the flow of goods between continents with unmatched efficiency by greatly reducing travel time and therefor any inherited costs.

Disruptions in these channels can have far-reaching implications, clogging up entire supply lanes, increasing shipping times, causing the rise of product prices, and affecting trade systems and economies worldwide.

The Strategic Importance of the Suez Channel and the Panama Canal for World Trade

The Suez Channel connects the Mediterranean Sea to the Red Sea and is a pivotal link to maritime trade between Europe and Asia. It is the shortest route between the two continents, that handled approximately 12% to 15% of global trade in 2023, making it one of the most heavily used shipping lanes in the entire world.

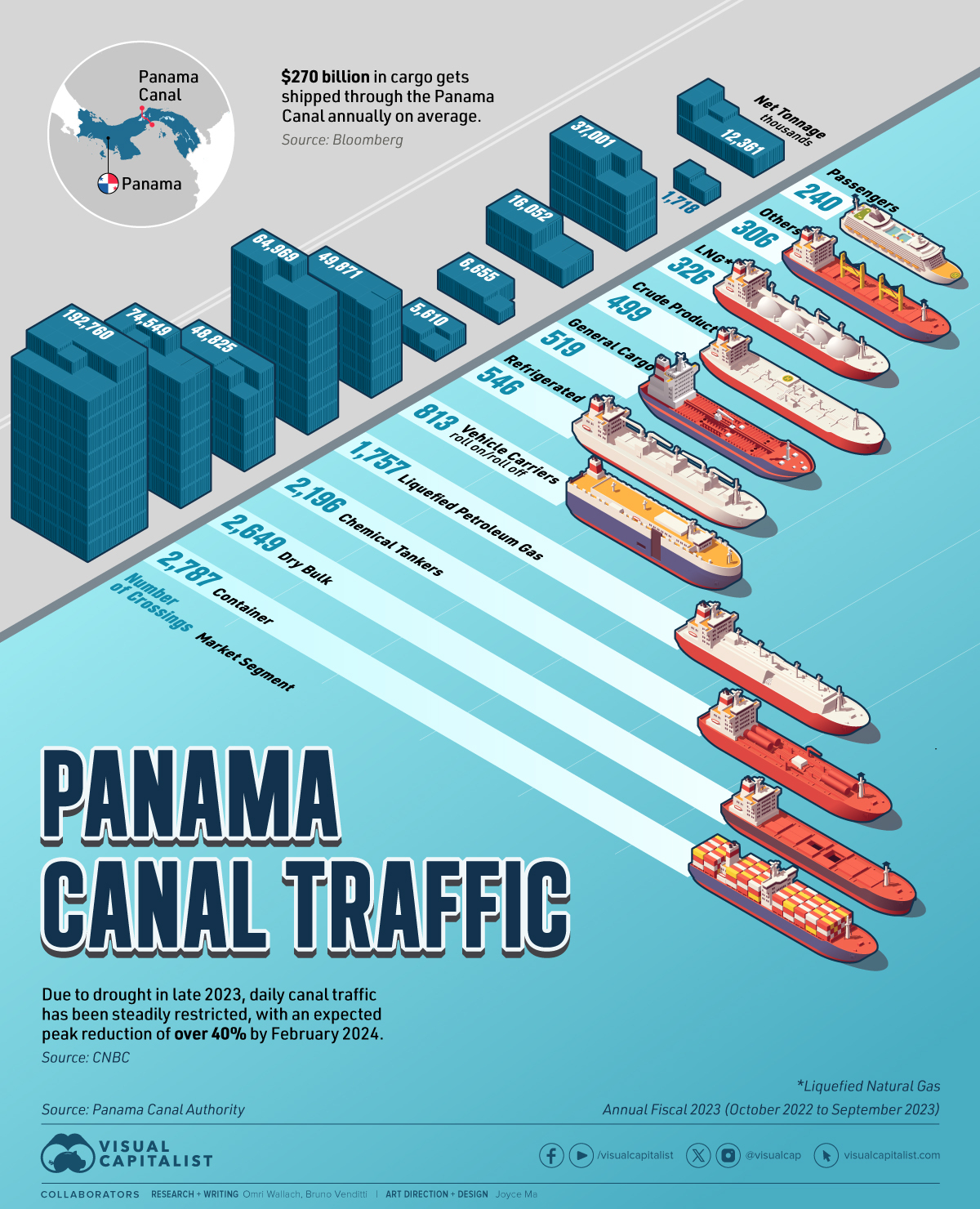

The Panama Canal on the other hand, connects the Pacific and Atlantic oceans and plays a critical role in facilitating trade between the East Coast of the United States, Asia, and Europe.

These channels are not mere transit points but critical nodes of the global supply chain, handling a huge percentage of the global maritime freight.

The Disruptions Happening Right Now at these two Channels

The UN’s trade and development body, UNCTAD, has raised profound concern over escalating disruptions to global trade.

The recent attacks to ships on the Red Sea, off the Yemen Coast, are forcing ships to take the longer route around the Cape of Good Hope which prolongs transit times by 10 additional days, greatly increasing shipping times and ramping up prices of the items being transported.

Indeed, since December of last year, there has been a 42% reduction in the volume of trade passing through the Suez Channel. This shift in routing has led to a significant surge in container freight rates, escalating from $930 in October 2023 to $4,828 by January 2024.

Due to climate change and the fact that the Panama Canal is constituted by a body of fresh water, which is being impacted right now by a very heavy draught, its daily levels of water are quickly dwindling. This is causing a huge percentage of bigger freight ships not being able to transverse the canal. In fact, the daily transit of ships has been reduced since last December from 38 ships to only 24 ships, and this is only possible by the controlled release of water from the Lake Alajuela, a secondary emergency reservoir for draught periods, which poses itself as a short-term solution.

It is also expected that this month of February the number of daily ships will decline to 18, which means the Panama Canal is only working at 40% of its capacity.

According to the New York Times the situation is so dire that some companies have decided to start paying $400.000 in an auction to move a ship ahead in the queue, with some companies of going to the point of paying $2 million, a cost they will support to make sure they don’t miss their next assignment.

The Immediate Impacts of these Disruptions

The Immediate Impact of these disruptions on both channels include:

1 - Increased Prices and Increased CO2 Emissions

As we have already mentioned disruptions on any of these channels cause significant increases in transit time, additionally ships rerouted from both channels are compelled to travel faster to compensate for these detours, burning more fuel per mile and there for emitting more CO2. This not only leads to increased prices for consumers, but also exacerbates further environmental concerns.

2 - Potential Halt of Production Lines

For industries relying on just-in-time deliveries, such as the automotive and electronics industries, these delays can completely halt production lines, leading to missed opportunities, heavy financial losses, and strained business relationships.

3 - Volatile Global Markets

The disruption or blockage of these channels can also disrupt the supply of essential commodities, such as oil, natural gas, and any agricultural products, leading to higher price volatility in global markets.

What about the Long-Term Economic and Operational Challenges?

The ripple effects of disruptions on these critical maritime routes extend beyond immediate logistic challenges, posing long-term economic and operational challenges:

Increased Inventory Levels - Businesses may have the need to increase their inventory levels and acquire bigger warehouses to store their goods, leading to higher operational costs.

The Need for Local Suppliers – Companies might have the need to reassess their dependence on supplier from distant regions and having to the need to opt for more local suppliers.

Increased Insurance Values – Even for the ships that can pass through these channels, insurers might consider a greater risk and therefor charge a higher premium due to the perceived higher risks of transversing them.

New Transportation Methods – Persistent disruptions may cause companies to opt for more expensive transportation methods such as rail or air, despite the higher costs.

How can Businesses Tackle these Challenges?

Here are a few strategies that organizations can adopt to navigate the uncertainties of the future of both the Suez Channel and the Panama Canal:

- Diversify their Supply Chains – By diversifying supply sources and logistic partners, companies can reduce their vulnerability to regional disruptions.

- Investment in Technology – Source-to-Contract (S2C) solutions like Scanmarket by Unit4, allow businesses to easily find local suppliers in detriment of supplier from more distant regions.

- Strategic Stockpiling – Maintaining high levels of inventory only for critical production components can serve as a buffer again supply chain disruptions, ensuring production never stops and at the same time reducing inventory costs.

- Collaboration and Communication – By maintaining a clear and strong communication with their logistic partners, suppliers, and customers, ensures that all parties are well-informed and can collaboratively manage any disruptions.

In Conclusion

The disruptions happening at the same time on the Suez Channel and the Panama Canal underscore the imperative for businesses to implement comprehensive risk management approaches.

Amidst a backdrop of global uncertainty, the critical role of these channels in maintaining the fluidity of international goods exchange is irrefutable. However, with proactive planning and adaptation, the global commerce community can counteract the adverse effects of such vulnerabilities, ensuring continuity and stability of their businesses in the face of adversity and these new challenges.